The city of Ann Arbor receives a new audit report each year — a lengthy document that provides an in-depth look at city hall's finances and how it performed the year before.

The latest audit shows the city's general fund, which pays for basic services like police and fire protection, had a $1.6 million surplus for the fiscal year ending June, 30, 2012.

That left the general fund with unassigned cash reserves equal to 19 percent of the total general fund budget, which is considered healthy.

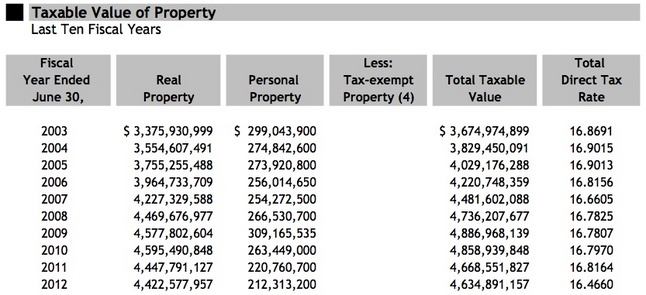

The audit shows the city took in $192.1 million in revenue from governmental and business-type activities, while it spent $155.3 million, leaving positive balances in all major categories.

Revenues up

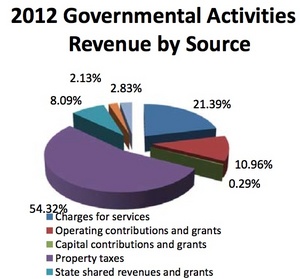

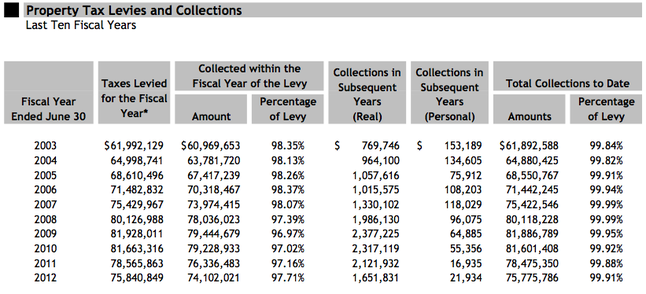

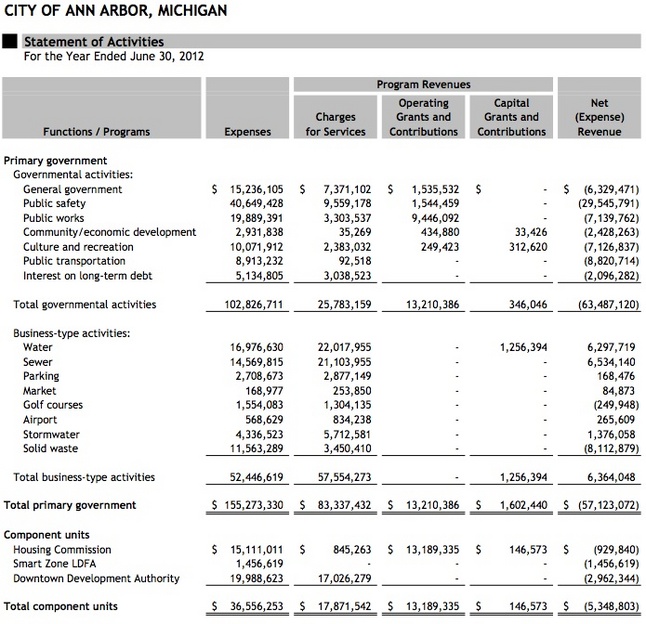

- Overall revenues were up $2.5 million or 1.3 percent from the year before, even though property tax revenues dropped by $2.1 million or 2.7 percent.

- Contributing to the city's positive financial performance was a one-time influx of $3.2 million from the sale of city-owned property at First and Washington.

- Revenues included $83.3 million in charges for services, $76.5 million in property taxes, $13.2 million in operating grants, $1.6 million in capital grants, $9.7 million in state-shared revenue and grants, $3.8 million in investment income and $3.9 million in other revenue, including the $3.2 million property sale.

City of Ann Arbor

Spending cuts

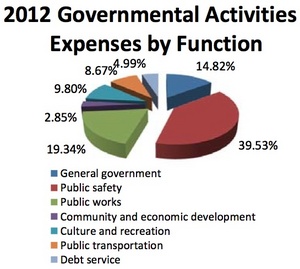

- Overall spending decreased by $5.1 million or 3.2 percent.

- Public safety costs dropped 3.3 percent to $40.6 million. Public works costs dropped 2.8 percent to $19.9 million. Community and economic development costs dropped 22 percent to $2.9 million.

- Solid waste costs dropped 15.7 percent to $11.6 million. Airport costs dropped 23.6 percent to $568,629. Golf course costs dropped 5.8 percent to $1.6 million.

- Water costs dropped 2 percent to $17 million. Public transportation costs dropped 4.8 percent to $8.9 million. Debt service costs dropped 2.3 percent to $5.1 million.

Spending increases

- Stormwater costs went up 9.9 percent to $4.3 million. Sewer costs went up 0.9 percent to $14.6 million. Culture and recreation costs went up 1.4 percent to $10.1 million.

- General government costs went up 3 percent to $15.2 million.

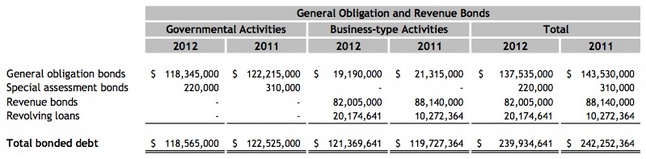

Bond debt drops

- The city's total bonded debt decreased by $2.3 million or about 1 percent, going from $242.3 million to $240 million.

- Of the total outstanding bonded debt, $118.6 million is backed by the full faith and credit of the city. The remainder of the city's debt represents bonds secured solely by specified revenue sources such as revenue bonds and revolving loans.

- State law limits the amount of the general obligation debt a governmental entity can issue to 10 percent of its total assessed valuation. The current debt limit for the city is $526.8 million, which is significantly in excess of the city's outstanding general obligation debt.

Longterm liabilities

- As of June 30, 2012, the city's pension plan was 82.7 percent funded (compared to 88 percent the year before). The liability for benefits was $496.8 million ($481.3 million the year before) and the value of assets was $410.7 million ($423.7 million the year before), resulting in an unfunded liability of $86.1 million ($57.6 million the year before).

- The city's annual required contribution for the pension plan was $9.4 million and the city's actual contribution was $10.5 million (111 percent). Employees contribute 5 percent or 6 percent of their annual pay depending on the employee group. The city's required contribution was $7.6 million in 2010 and $8.7 million in 2011, and the city contributed 100 percent both of those years.

- As of June 30, 2012, the retiree health care plan was 35.1 percent funded (compared to 34 percent the year before). The liability for benefits was $249.8 million and the value of assets was $87.7 million, resulting in an unfunded liability of $162.2 million.

- The city contributed $11.1 million to the retiree health care plan, including $8.9 million for current premiums (56 percent of total health care premiums) and $2.2 million to pre-fund benefits.

- The annual payroll of active employees covered by the city's pension and retiree health care plans was $44 million.

Other highlights

- The city's net assets increased by $36.8 million primarily due to increases in capital assets.

- Charges for services increased roughly 5 percent largely due to an increased volume of fire inspections, building permits and hydropower services, as well as new fees for enhancements to the Argo Liveries.

- The city's assets exceed liabilities by more than $1 billion. Of that amount, $867.8 million is invested in capital assets, $88.5 million is restricted for specific purposes, and $73.5 million is unrestricted.

- The unrestricted balance includes $23.9 million in governmental activities and $49.5 million in business-type activities.

- The general fund has a $14.1 million unassigned fund balance.

- The street repair fund balance ($25 million) decreased by $4.2 million due to planned use of fund balance for construction projects, including funds set aside for the Stadium bridges project that were repurposed after state and federal grant funding was received.

- Unrestricted net assets of the water, sewer, stormwater, parking system, market, golf courses, solid waste and airport at the end of the year amounted to $49.5 million. All funds had an increase in net assets for the year totaling $16.6 million.

- The city's investments included $89.1 million in U.S. treasuries, $83.3 million in U.S. agencies and $11.9 million in money market accounts for a total of $184.2 million.

City of Ann Arbor

A look a the city's bonded debt as reported in the latest audit.

City of Ann Arbor

A chart from the audit showing a history of tax collections in Ann Arbor.

City of Ann Arbor

An indication of the city's tax base showing property wealthy in Ann Arbor.

City of Ann Arbor

Notes from the auditor

As part of its audit of the city's finances, the Rehmann accounting firm noted the following concerns about the city's internal controls and recommended they be addressed.

- Instances where an employee's time input did not bear evidence of direct supervisor review and approval as required by the city's policies and procedures.

- Three instances where an employee was requesting and receiving mileage reimbursements while also receiving a vehicle allowance.

- Three instances ranging in dollar amount from $3,000 to $44,000 where a family member of a city employee had a contract with the city to provide goods or services.

Other recommendations from auditor

- The city should review its internal audit procedure and determine if it would be more effective if the internal auditor reported directly to the audit committee instead of the chief financial officer.

- The city should consider enhancing information technology controls for four reasons: Passwords are not required to be changed at regular intervals. The city does not have a disaster recovery plan. A backup and data retention policy does not exist and backups are not tested. And employees are not required to lock computer screens when leaving their work stations.

The city's response

Ryan J. Stanton covers government and politics for AnnArbor.com. Reach him at ryanstanton@annarbor.com or 734-623-2529. You also can follow him on Twitter or subscribe to AnnArbor.com's email newsletters.